San Diego Home Insurance Fundamentals Explained

San Diego Home Insurance Fundamentals Explained

Blog Article

Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Plans

Significance of Affordable Home Insurance

Securing economical home insurance policy is critical for guarding one's residential property and monetary wellness. Home insurance gives protection versus different risks such as fire, burglary, natural disasters, and personal liability. By having a thorough insurance coverage plan in position, house owners can relax guaranteed that their most significant financial investment is safeguarded in the event of unanticipated conditions.

Budget-friendly home insurance not just offers economic safety and security however also uses satisfaction (San Diego Home Insurance). Despite rising building worths and building prices, having a cost-efficient insurance plan ensures that home owners can conveniently restore or fix their homes without dealing with considerable financial burdens

In addition, budget-friendly home insurance coverage can also cover personal items within the home, using compensation for products harmed or stolen. This protection expands beyond the physical structure of your home, shielding the contents that make a house a home.

Protection Options and Purviews

When it concerns protection limitations, it's critical to understand the maximum amount your policy will certainly pay for each and every sort of coverage. These limitations can vary depending on the policy and insurance firm, so it's essential to review them carefully to ensure you have adequate defense for your home and properties. By recognizing the protection choices and limitations of your home insurance coverage, you can make informed decisions to safeguard your home and loved ones effectively.

Elements Affecting Insurance Prices

Several variables significantly influence the prices of home insurance coverage policies. The place of your home plays an essential duty in figuring out the insurance policy premium.

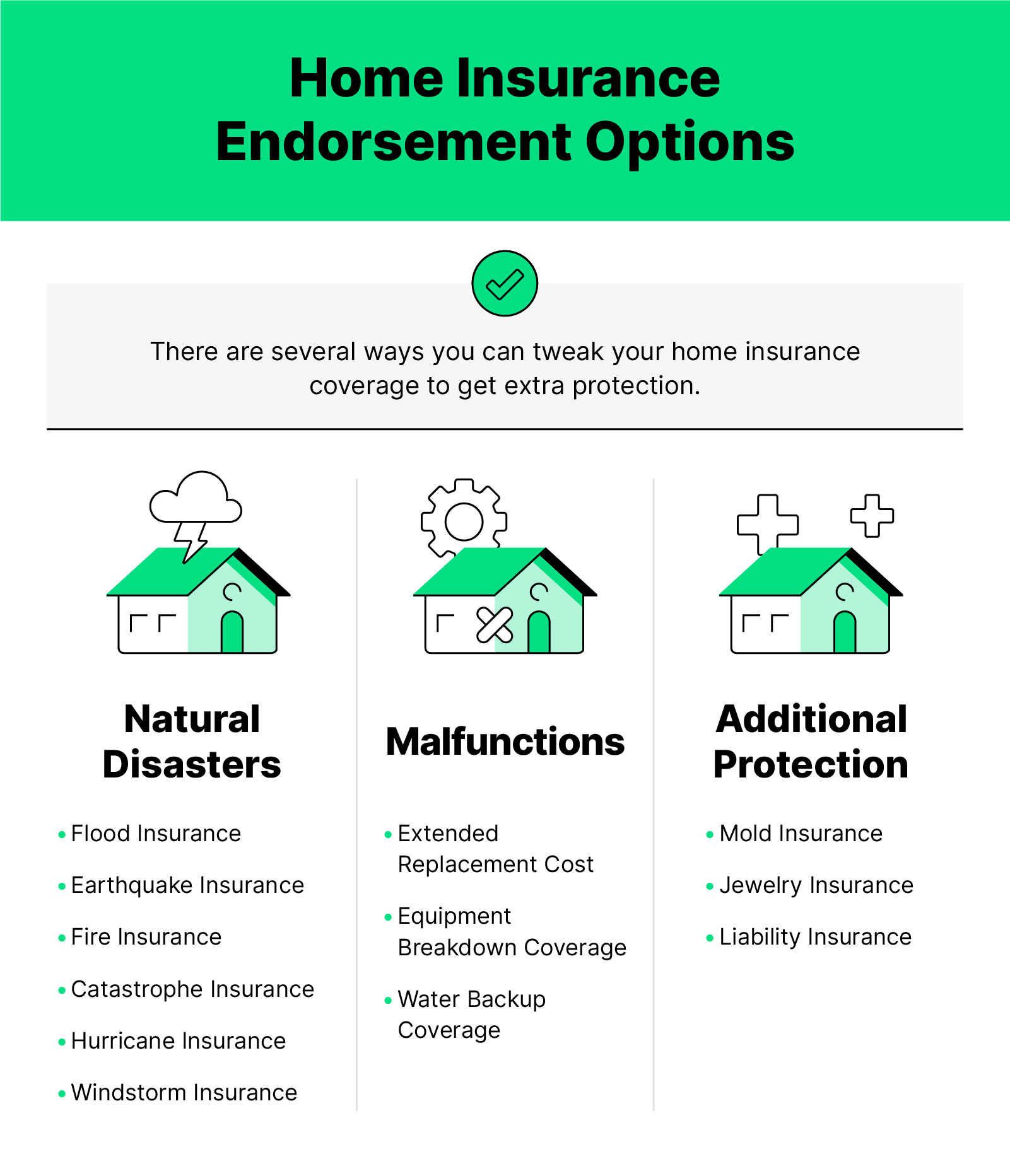

In addition, the type of coverage you select directly affects the price of your insurance coverage policy. Choosing for extra insurance coverage alternatives such as flooding insurance policy or quake insurance coverage will certainly raise your costs.

In addition, your credit report, declares background, and the insurer you pick can all affect the cost of your home insurance coverage. By thinking about these aspects, you can make educated decisions to assist manage your view website insurance policy sets you back properly.

Contrasting Companies and quotes

:max_bytes(150000):strip_icc()/dotdash-home-warranty-vs-home-insurance-5081270-Final-b2fa2539ff3c475296bae8529873651f.jpg)

Along with contrasting quotes, it is crucial to assess the credibility and monetary security of the insurance suppliers. Seek consumer testimonials, rankings from independent firms, and any kind of background of issues or governing activities. A dependable insurance coverage company must have a great performance history of immediately processing claims and providing excellent customer solution.

In addition, take into consideration the certain coverage attributes used by each service provider. Some insurance companies might offer fringe benefits i was reading this such as identification theft protection, tools breakdown coverage, or protection for high-value items. By meticulously comparing carriers and quotes, you can make a notified choice and choose the home insurance policy plan that ideal satisfies your demands.

Tips for Saving Money On Home Insurance Policy

After thoroughly contrasting companies and quotes to find the most appropriate coverage for your demands and budget plan, it is sensible to check out effective approaches for saving on home insurance policy. Lots of insurance coverage companies offer price cuts if you buy multiple policies from them, such as combining your home and car insurance. Regularly examining and updating your policy to mirror any kind of adjustments in your home or scenarios can ensure you are not paying for coverage you no longer requirement, helping you save cash on your home insurance policy premiums.

Verdict

In verdict, guarding your home and liked ones with budget friendly home insurance is crucial. Implementing tips for conserving on home insurance can also help you secure the necessary defense for your home without damaging the bank.

By deciphering the complexities of home insurance strategies and discovering sensible approaches for protecting budget-friendly protection, you can ensure that your home and enjoyed ones are well-protected.

Home insurance policy policies typically supply a number of protection alternatives to secure your home and items - San Diego Home Insurance. By recognizing the protection options and limits of your home insurance coverage policy, you can make informed choices to protect your home and enjoyed ones successfully

Routinely reviewing and upgrading your policy to show any adjustments in your home or scenarios can Visit This Link ensure you are not paying for insurance coverage you no longer need, helping you conserve money on your home insurance premiums.

In verdict, securing your home and liked ones with affordable home insurance policy is vital.

Report this page